On August 16, 2024, the State Administration for Market Regulation (SAMR) published the “Guidelines for Discretionary Standards in Imposing Penalties for Illegal Implementation of Concentration of Undertakings (Draft for Comments)” (the “Draft“). The Draft marks the first specialized administrative penalty guideline issued by China’s antitrust enforcement authority to specifically address certain monopolistic behaviors. The Draft clarifies in detail the foundational principles, the procedural steps, and the other considerations and factors that will guide antitrust enforcement agencies in determining the penalties for the illegal implementation of a concentration.

The amendments to the Anti-Monopoly Law (AML) in 2022 significantly increased the penalties for the illegal implementation of a concentration. Under the amended AML, antitrust enforcement agencies now have the authority to impose fines of up to RMB 5,000,000 (approximately USD 702,275) for concentrations that do not raise competition concerns, a substantial increase from the previous limit of RMB 500,000 (approximately USD 70,227).

For concentrations that do raise competition concerns, the maximum fine has been increased to 10% of the company’s sales from the previous year. In particularly severe cases — characterized by especially harmful effects or serious consequences — the fine may be set at more than double, but less than five times, the original amount — i.e. that 10% fine amount may be further increased by 200% to 500%. Given this potential for significant fines, a clarification on the discretionary standards used by antitrust enforcement agencies in determining fines was critical for companies to accurately assess risks and develop effective compliance strategies. The Draft addresses this critical need.

This briefing will analyze the key provisions of the Draft, aiming to help enterprises understand the potential risks and compliance obligations under the proposed legal framework.

Please click here to view the PDF version.

I. What circumstances create an illegal implementation of a concentration of undertakings

Article 2 of the Draft categorizes illegal implementations of a concentration under the Anti-Monopoly Law into four distinct groups:

1. Failure to notify when required: The most common form of an illegal implementation of a concentration results from the failure to notify when a transaction meets the notification thresholds. When evaluating the need for notification, an enterprise needs to pay close attention to the typical pitfalls that can lead to it mistakenly determining that the transaction can go unreported:

- Miscalculating turnover: Common mistakes include calculating turnover based solely on the notifying party rather than the entire group or focusing exclusively on the turnover associated with the transaction itself.

- Ignoring minority equity acquisitions: A frequent misconception is that the acquisition of minority stakes never requires notification. However, past enforcement cases have demonstrated that acquiring a minority interest of less than 10% may require notification if it effectively results in the acquirer gaining control.

- Ignoring a potential change in control through contract arrangements: Some mistakenly believe that obtaining control through contract arrangements does not constitute a concentration. Actually, control can be acquired through various contractual forms. Common examples include: custodian agreements; mandatory convertible bonds; delegation of voting, nomination or proposal rights; amendments to joint venture agreements or articles of associations; concerted action agreements; commitments to waive voting rights; and share entrustment arrangements.

- Misunderstanding notification timing in multi-step transactions: In transactions structured in multiple steps, inaccurately assessing whether the different steps constitute a “package transaction” can lead to notification failures before the first step is completed. The Canon/Toshiba case is an example of this notification failure.

2. Failure to notify a below-threshold transaction that raises competition concerns: The 2022 amendment of the AML emphasized the enforcement agency’s right to require notification for below-threshold transactions that may raise competition concerns. Therefore, for transactions that may attract scrutiny from enforcement agencies, enterprises should carefully consider notifying the enforcement authorities of the transaction.

3. Implementation after notification but before approval (i.e. gun-jumping): As outlined in Article 8 of the “Regulations on Merger Review,” certain actions taken prior to obtaining approval may be classified as “gun-jumping.” These actions can include completing business entity registrations or registering changes in rights, appointing senior management personnel, actively engaging in operational decision-making and management, exchanging sensitive information, and significantly integrating business operations, among others.

4. Violation of conditional approvals or outright prohibitions: If the antitrust enforcement agency imposes restrictive conditions or outright prohibits a concentration, the obligations outlined in the review decision must be strictly adhered to. Failure to comply with these requirements may result in legal liability.

II. What entities are subject to administrative penalties?

Article 4 of the Draft delineates the entities subject to administrative penalties based on the nature of the concentration. For mergers, all merging parties are subject to penalties; for other concentrations, the entity that gains control or exerts decisive influence is subject to penalties.

The Draft does not specify whether the penalized entity should be the ultimate controller or the signatory to the transaction agreement. Depending on which of the two is the penalized entity, it could significantly impact the penalty amounts for violations in transactions that raise competition concerns.

In practice, enforcement agencies vary in determining the liable entity. Their determinations may be based on whether an entity is directly involved in the transaction, whether it signs the transaction documents (including special purpose vehicles established for the transaction), and whether a parent company or other upstream controlling party that controls the entity should be liable.

Furthermore, the Draft has not yet provided clear guidance on some other common issues for determining the parties subject to penalties. Take, for instance, a two-step transaction structure for establishing a joint venture between two parties, where the first step involves one party setting up a wholly-owned subsidiary, and the second step involves the other party acquiring partial equity in this subsidiary, with the resulting joint venture jointly controlled by both parties. If the Draft provisions are strictly followed, the subject of administrative penalties should be the party acquiring joint control in the second step and not the party that established the wholly-owned subsidiary in the first step even though that party is a joint controller. This strict interpretation of the Draft would overlook the integrity of the transaction and could lead to unfair penalty outcomes. We anticipate that the final version will provide more explicit guidance on this and other issues.

III. How are penalties determined for concentrations without competition concerns?

For an illegal implementation of a concentration that does not exclude or restrict competition, a fine is the primary administrative penalty. The fine amount is determined in two steps: (1) determine the preliminary fine amount; and (2) determine whether to apply “upward” or “downward” adjustments based on the transaction circumstances.

1. Determining the initial fine amount

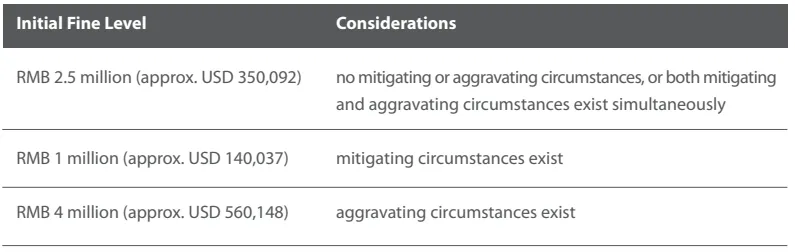

Based on whether mitigating or aggravating circumstances are involved, the initial fine amount is divided into three levels:

As for what constitutes mitigating and aggravating circumstances, the Draft describes them as:

- Mitigating circumstances: Mitigating circumstances include when the operator: voluntarily reports the facts of the illegal concentration before the antitrust enforcement agency discovers them; immediately takes measures to prevent the implementation of anti-competitive effects or to eliminate those effects once the case s filed; or implements the concentration only as a result of coercion or deception by another.

- Aggravating circumstances: Aggravating circumstances include when the operator: instigates, coerces, or deceives others causing them to illegally implement a concentration of undertakings; repeated violation within one year; fails to cooperate with law enforcement; or forges or conceals evidence.

2. Determining “upward” and “downward” adjustments

After determining the initial fine amount, further analysis is conducted to identify any factors requiring upward or downward adjustments to the fine amount. The Draft describes those factors as:

- Upward factors: These upward factors include actions such as providing false information, failing to cooperate with the investigation, implementing a below-threshold concentration that has anti-competitive effects and was not notified when called in. For each upward factor identified, the fine amount may increase by 10% to 20%.

- Downward factors: The downward factors include the post-concentration entity is yet in operation, or the party subject to penalty is a first-time violator, actively cooperates with enforcement agencies, proactively establishes a compliance system, and has below the turnover threshold. For each downward factor, the fine amount is reduced by 10%, but the cumulative minimum fine after reduction may not be less than 40% of the initial fine amount.

IV. How are penalties determined for concentrations with competition concerns?

For an illegal implementation of a concentration that raises competition concerns, penalties include unwinding the transaction and imposing a fine of up to 10% of the previous year’s sales.

When determining the fine amount, the process will be similar to the two-step process for determining the fine for an illegal implementation of a concentration that does not have the effect of eliminating or restricting competition. However, the Draft provides no details on mitigating or aggravating circumstances or on upward and downward factors. Instead, Article 11 merely states that: “the final fine amount will be determined by comprehensively considering factors such as the timing of the implementation, the duration and scope of its effect of eliminating or restricting competition, and the situation regarding the elimination of consequences of the illegal conduct.” With this uncertainty in how fines will be determined, the final version will hopefully contain additional clarification.

V. Are there any exemptions from administrative penalties?

Article 15 of the Draft outlines specific conditions under which illegal implementations that do not exclude or restrict competition may be exempt from administrative penalties. These conditions include:

- Voluntary reporting and status restoration: For first-time offenders, if the party voluntarily reports the illegal conduct and takes appropriate measures to restore the status quo, the party may qualify for an exemption.

- Violation due to force majeure: If, after the enforcement agency conducts an assessment and determines the violation to be the result of unforeseeable, unavoidable, and insurmountable objective circumstances, the party may also be exempt from penalties.

VI. What antitrust compliance incentives are there?

To encourage enterprises to build and implement antitrust compliance systems, the Draft emphasizes that the establishment and implementation of an antitrust compliance system can be a factor in reducing penalties. This provision echoes the compliance incentive system proposed in the “Antitrust Compliance Guidelines” released in 2024 and the “Antitrust Compliance Guidelines for Concentration of Undertakings” released in 2023.

VII. What actions should enterprises take?

Although the Draft has not yet been formally issued, it provides guidance for enterprises to comply with merger control rules:

- Accurately assess notification obligations: It is crucial to accurately assess whether a transaction triggers the filing obligations and to determine the appropriate timing for notification. Furthermore, understanding which key actions constitute the “implementation” of a transaction is crucial for avoiding illegal “gun-jumping”.

- Conduct substantive risk assessments: For transactions that are below the reporting thresholds but raise competition issues, it is crucial to conduct substantive antitrust risk assessments as early as possible.

- Implement penalty mitigation measures: Once an illegal implementation of a concentration of undertakings is discovered, the following measures should be taken to mitigate penalties:

-

- Promptly and proactively report the transaction to SAMR and actively cooperate with the investigation

- Provide truthful information and corresponding evidence

- Timely establish and implement a comprehensive antitrust compliance management system

- Where commercially feasible, consider immediately ceasing the implementation, or even taking measures to restore the status quo.

- Avoid repeat violations: Any enterprise that has previously been penalized for an illegal implementation of a concentration should further strengthen its compliance management to prevent any further violations to avoid more severe penalties.