Have the increased merger control thresholds resulted in a drop in notifications? Do stop-the-clock measures effectively handle historically uncertain review timelines? Is there a rise in below-threshold reviews in light of the increased turnover thresholds introduced this year? We recap the key merger control developments in China from the initial half of this year.

KEY POINTS

- Increased merger control thresholds reduce the volume of notifications. Increased turnover thresholds introduced in January 2024 have led to a 22.5% decrease in notifications compared to the year before, primarily affecting simple case filings.

- Simple case reviews are speedier than ever. Simple case reviews now take an average of 18 days to review, aligning with unofficial KPIs set by case teams, aiming to secure case acceptance within 20 days, followed by an additional 20 days during the Phase I period. These timeframes may get even shorter in the near-term as the authority continues to refine its requirements and processes, including through local delegation and a fresh short form template.

- Stop-the-clock measures aren’t promising any reductions in review timeframes. Stop-the-clock measures haven’t significantly reduced review timeframes since being introduced two years ago, with timeframes suspended up to nearly a year in recent examples like JX Nippon/Tatsuta (2024).

- Unsung call-in powers introduce uncertainty. The authority’s ability to call in below-threshold transactions appears more prevalent following the turnover threshold adjustments earlier this year. Recent examples, including the review of the Synopsys/Ansys deal, show that deal parties operating in highly concentrated markets with exposure to sensitive sectors in China are under close scrutiny even if they do not meet the turnover thresholds, but especially if they meet the old thresholds.

- First remedy case of the year goes to… the semiconductor industry. The authority’s first conditional clearance decision of the year involved conglomerate effects concerns related to critical components linked to China’s sensitive chip sector. Behavioral remedies lasting 8 years were imposed to tackle possible anticompetitive tying/bundling practices and interoperability issues.

- Costs-benefits of the proposed merger guidelines? The draft horizontal merger guidelines currently under consultation introduce new frameworks (and certainty) for defining relevant markets that were previously ambiguous, but potentially necessitate markets to be defined for more than half of the total business under review. The guidelines were also expected to but do not shed any meaningful light on how complex trade-related issues should be assessed in competition assessments, including foreign export control restrictions that often trigger security of supply remedies in many of the conditional clearances in China’s recent history.

Please click here to view the PDF version.

1. Increased merger control thresholds lead to decreased notification volumes by almost a quarter

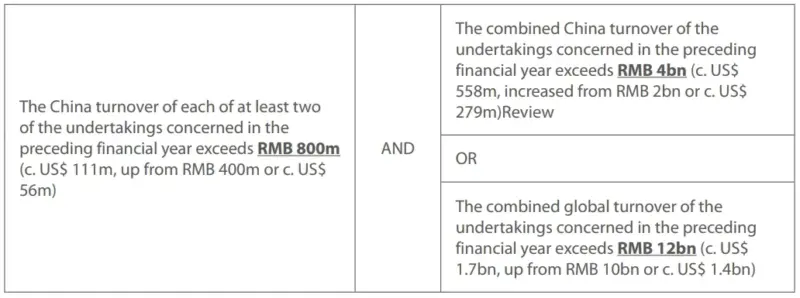

In January 2024, China’s new merger control thresholds came into effect, doubling the individual China turnover thresholds from RMB 400m (around US$56m) to RMB 800 million (around US$111m).[1] As expected, the increased merger control thresholds have brought a significant reduction in the number of merger control notifications, especially for those qualifying for the simple case procedure in China:

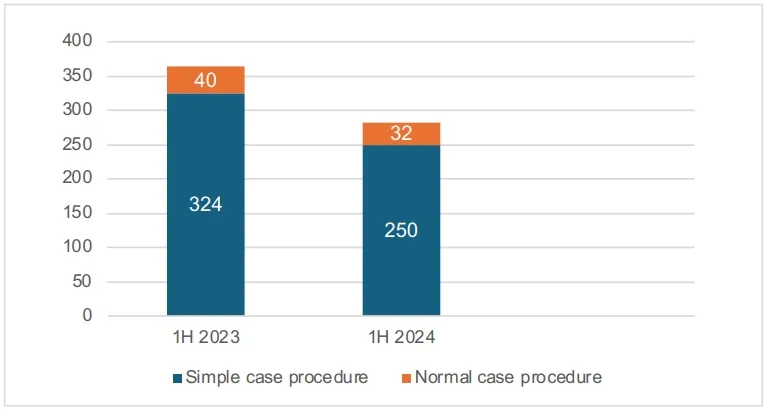

- In the first half of 2024, the State Administration for Market Regulation (“SAMR”) cleared a total of 282 transactions. This represents a 22.5% decrease compared to the same period the previous year.

- The primary driver of the decrease was a drop in simple case notifications, which declined from 324 notifications in the prior year to 250 notifications in the first half of 2024.

- In contrast, the number of notifications made under the normal case procedure remained relatively similar between the two time periods.

Figure 1: Volume of unconditional clearances between 1H 2023 and 1H 2024

For more details about the amended thresholds, read our update here. The updated thresholds are as follows:

2. Simple case reviews are speedier than ever

The 20/20 rule

Informally, SAMR’s case teams are targeting a “20/20 rule” with the goal of securing case acceptance within 20 days and subsequently granting clearance within an additional 20 days during the Phase I period.

Transactions that are reviewed under the simple case procedure are typically cleared within the 30-day Phase I period. In practice, simple cases filed in the first half of 2024 took an average of around 18 days to review, compared to an average of 21 days for the same time period in 2023. This excludes the pre- case acceptance period.

Local agencies drive efficiencies

Simple case reviews are much more efficient after nearly two years since the inception of the 2022 pilot program to assign simple case reviews to local agencies in Beijing, Shanghai, Guangdong, Chongqing and Shan’xi Provinces.[2] These agencies:

- reviewed 70% of simple cases in H1 2024 compared to 41% of simple cases the year before; and

- took an average of around 16 days to complete simple case reviews compared to SAMR’s average of around 21 days in H1 2024.

Revamped short form template coming soon…

Even the most basic notifications in China can prove to be challenging due to the substantial amount of information that is typically required to be submitted, including comprehensive market share data.

In April 2024, SAMR published a revised draft template notification form for simple cases, with the aim of minimizing the information demands on deal parties in the following scenarios: [3]

- Offshore transactions. Market share data and an accompanying competition analysis does not need to be provided for “purely offshore transactions” that have no nexus to China. Currently, many deal parties still need to request for a waiver to provide market share information in offshore cases.

- De minimis market shares. In circumstances where the parties account for less than 5% of the relevant market, and it is challenging to obtain third-party data, the market share data can be limited to the market shares of the parties involved. There would be no need to include competitor market shares.

In other circumstances, the information requirements may be more onerous. For greenfield joint ventures, it is now also necessary to provide a reasonably estimated market share that the joint venture is expected to achieve within three years after commencing operations. Our experience shows that this requirement has already been informally adopted by SAMR’s case handlers in recent cases.

A key challenge frequently encountered by deal parties, but which the proposed form does not directly resolve, is whether internal market share data would be sufficient, or if credible third-party information needs to be provided instead. In the context of de minimis market shares accounting for less than 5%, the template notification form briefly mentions that competitor data does not need to be provided to the extent market share data from a credible third party proves difficult to obtain. In other words, the template form operates under the assumption that third-party data is required. This is also reflective of our recent experience. Today, internal estimates are seldom satisfactory unless corroborated by detailed calculation methods and third-party data and sources.

The public consultation period for the draft short form filing form ended on April 22 and it is still unclear when the revised simple case form will be finalized and made publicly available.

3. Stop-the-clock measures aren’t promising any reductions in review timeframes

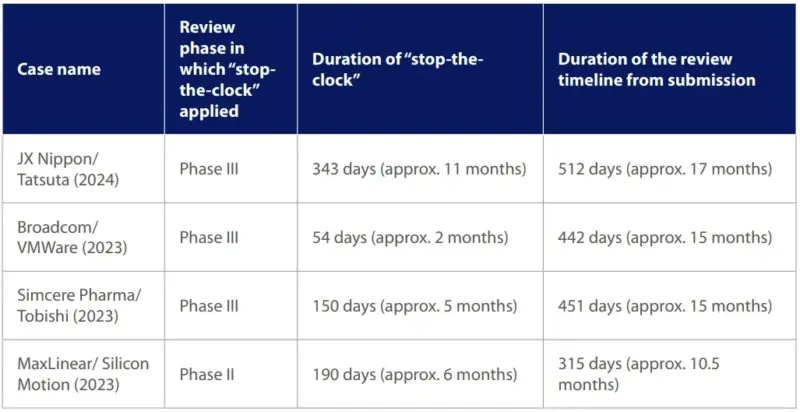

Powers to “stop-the-clock” [4] during merger reviews introduced two years ago were amongst the most significant modifications to China’s amended Anti-Monopoly Law. Specifically, these powers were anticipated to reduce extended review timeframes for complex cases by replacing SAMR’s long-standing pull-and-refile mechanism, which requires parties to resubmit their notifications at the conclusion of the maximum statutory 180-day review period.

Based on SAMR’s latest practices, there is uncertainty about whether the use of stop-the-clock measures would have the effect of shortening review timeframes. In the conditional clearance decision of JX Nippon/ Tatsuta (2024), [5] review timeframes were suspended for nearly a year, spanning from 11 July 2023 to 7 June 2024. Based on public information, SAMR has exercised its “stop-the-clock” powers in four merger reviews to date, ranging from 2 to 11 months.

Table 1: Reviews in which stop-the-clock has been applied in China

In all four cases, the review timeframes significantly exceeded the maximum statutory timeframe of 180 days on paper. The reviews in almost all cases took double the time, and in JX Nippon/ Tatsuta, almost three times the statutory time limit in China.[6]

4. Unsung call-in powers introduce uncertainty

SAMR has powers to call-in transactions that do not meet the turnover thresholds but that have or may likely have the effect of eliminating or restricting competition in China.[7]

After China’s turnover thresholds were increased in January, there has been greater uncertainty about the risks of SAMR exercising its powers to review transactions that would have met the previous, lower turnover thresholds. In particular, the amendments that implemented the new, higher turnover thresholds also reference SAMR’s ability to call in transactions for review, contributing to this uncertainty.[8]

Whilst SAMR’s “call-in” powers have existed for some time, they were rarely exercised until certain amendments were made to China’s competition laws in 2022. In late 2023, SAMR (for the first time) imposed remedies on a transaction that did not meet the turnover thresholds. In Simcere/Tobishi (2023),[9] SAMR was concerned about potential horizontal overlaps between the parties although its decision to call-in the transaction may have been influenced by SAMR’s 2021 decision to fine Simcere (the acquirer) for abusing its dominant position by refusing to supply certain pharmaceutical ingredients to Tobishi (the target).

There have been a number of cases this year that were reportedly flagged as potential suspects for being called-in despite not meeting the new turnover thresholds.

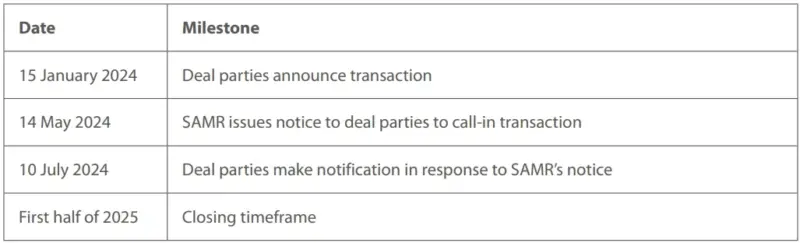

- The USD 35 billion proposed acquisition of Ansys by Synopsys has been confirmed to have been called-in despite not meeting the turnover thresholds in China.[10] The deal parties are broadly active in simulation software and electronic design automation tools and have reportedly significant key strategic sectors in China, including semiconductors, automotive and aerospace.

Table 2: Key milestones of Synopsys/Ansys transaction in China

- Qualcomm’s proposed acquisition of Autotalks was reportedly also flagged for review by SAMR. The deal would have combined two of the biggest makers of manufacturers of “vehicle-to-everything” or V2X semiconductors. The deal was ultimately abandoned in March 2024 due to antitrust concerns in Europe and the United States in particular.[11]

- Another below-threshold transaction that was ultimately cleared with remedies is J.X. Nippon Mining & Metals’ acquisition of Tatsuta Electric Wire (see further details below). The deal was filed with SAMR in January 2023 under the old turnover thresholds but fell outside the revised thresholds effective January 2024. SAMR declined the request from the deal parties to withdraw the filing based on the new turnover thresholds, as it did for other transactions.[12]

These developments underscore that deal parties operating in highly concentrated markets or sensitive sectors to China must carefully evaluate any risks of being “called-in” by SAMR as early as negotiating any antitrust conditions precedent in transaction documents.

5. First remedy case of the year goes to… the semiconductor industry

In June 2024, SAMR issued its first conditional clearance decision of the year. The deal attracted long review timeframes (see above, the review clock was stopped for almost a year) and remedies due to exposure to China’s sensitive chip sector, particularly downstream manufacturers of flexible printed circuit boards.

In JX Nippon’s acquisition of Tatsuta,[13] SAMR adopted a pure conglomerate effects theory of harm and was concerned about the adjacent markets between JX Nippon’s blackened rolled copper foil and stainless-steel stiffeners for flexible printed circuits and Tatsuta’s electromagnetic interference shielding films and isotropic conductive films. Each of these products is used in the manufacture of flexible printed circuits. JX Nippon and Tatsuta were found to have significant market power and held leading positions in the markets for blackened rolled copper foils and isotropic conductive films. SAMR was concerned about potential tying/bundling practices and found that the combined entity would have the ability and incentive to eliminate or restrict competition in the China markets for each of the flexible printed circuit component products through tie-in sales.

As is common in China, SAMR imposed behavioral remedies, requiring the parties to (i) refrain from tying or bundling practices; (ii) continue to supply products on fair, reasonable and non-discriminatory (FRAND) terms; and (iii) maintain interoperability between the parties’ products with third-party FPC components. The remedies are effective for eight years.

6. Costs-benefits of the horizontal merger guidelines

The recently released draft Horizontal Merger Guidelines demystify many of the tricky aspects of SAMR’s merger work and requirements that were previously ambiguous.[14] Read our full update here. This includes how to identify relevant markets, particularly in cases where there are no evident overlaps between the transaction parties.

- Relevant markets based on proportion of revenues. Conventionally, markets are defined based on overlaps between the transaction parties. The Guidelines propose that if revenues related to the overlapping products/services account for less than 50% of total revenues, then SAMR may require the parties to define relevant markets based on all their business activities. For example, if relevant markets are defined based on overlaps concerning a business unit that accounts for less than half of all revenues, then SAMR could force parties to define additional markets covering all other business units in which the parties do not overlap. An exception to this rule is where any non-principal business of the transaction parties has a market share of less than 5% and accounts for less than 5% of revenues.[15]

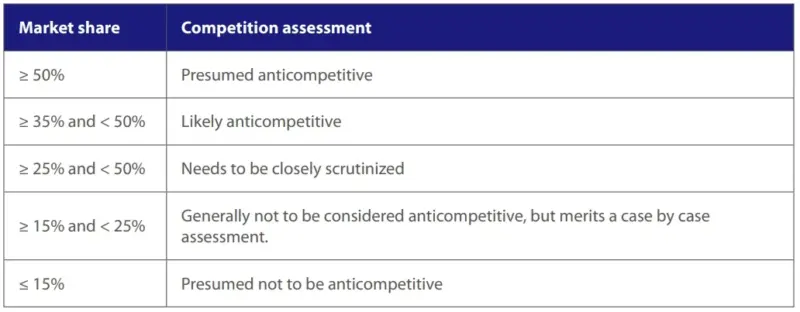

- Scrutiny based on market shares. The Guidelines also establish various market share thresholds that trigger presumptions or further examination.

Table 3: Market share threshold scrutiny

Along with these market share thresholds, the Guidelines also include HHI and Delta levels to further assess and determine whether a merger is anticompetitive. For instance, if the HHI is greater than 1800 and the Delta level is greater than 200 post-merger, then the merger is presumed to be anticompetitive. This is in line with the HHI and Delta levels published by the US Federal Trade Commission in its equivalent 2023 guidelines.[16]

Security of supply?

A key aspect that was expected to be covered in the Guidelines, but was ultimately not addressed, is how SAMR would handle complex trade-related issues, including export control restrictions imposed by other countries. Based on many remedy cases in recent years, it is fairly common for SAMR to implement measures to guarantee security of supply of products/ services, often in order to counteract export control restrictions enacted by other jurisdictions.

The Guidelines do not explicitly address these specific issues but do provide that SAMR can adjust the proper delineation of relevant markets where customers are unable to access products due to statutory restrictions, policy decisions, or administrative measures, or when the procurement environment has undergone changes. In these circumstances, SAMR may choose to define the relevant market based on the availability of the product or the specific customer group that is impacted.

- Article 3 of the Provisions of the State Council on Thresholds for Prior Notification of Concentration of Undertakings. ↑

- On 15 July 2022, SAMR announced a pilot program commencing 1 August 2022 to delegate the review of certain simple case filings to five of its local counterparts in Beijing, Shanghai, Guangdong, Chongqing and Shan’xi Provinces during a three-year pilot period. ↑

- Revised Notification Form for Simple Cases in Concentration of Undertakings (Draft for Comments). ↑

- The “stop-the-clock” mechanism refers to the regime allows SAMR to pause the statutory review timeframe under certain circumstances, including: (i) the parties’ failure to submit supporting information in a timely manner; (ii) new circumstances materially impacting the review arise; and (iii) further evaluation of remedy conditions is required (provided that the filing parties consent). ↑

- SAMR’s decision (11 June 2024), please see: https://www.samr.gov.cn/fldes/tzgg/ftj/art/2024/art_ee026cc074884d50ade381f916ab943a.html ↑

- The maximum statutory timeframe in China is 180 days accounting for all three review phases. ↑

- Article 26 of the Anti-Monopoly Law. ↑

- Article 4 of the Provisions of the State Council on Thresholds for Prior Notification of Concentration of Undertakings ↑

- SAMR’s decision (22 September 2023), please see: https://www.samr.gov.cn/fldes/tzgg/ftj/art/2023/art_90a71deadd224689b026920807c0389c.html ↑

- Public Announcement of Ansys, Inc. (12 July 2024), please see: https://investors.ansys.com/static-files/f81c9991-0a27-4422-803b-2cfbfc76a22d. ↑

- US Federal Trade Commission’s Press Release (25 March 2024), please see: https://www.ftc.gov/news-events/news/press-releases/2024/03/statement-regarding-termination-qualcomms-proposed-acquisition-autotalks ↑

- Public Announcement of J.X. Nippon Mining & Metals Corporation (29 February 2024), please see: https://www.hd.eneos.co.jp/english/newsrelease/upload_pdf/20240229_02_01_0960492.pdf ↑

- See footnote 5. ↑

- Guidelines on Review of Horizontal Concentration of Undertakings (Draft for Comments). ↑

- For example, if we assume that (i) the target comprises four business units (A, B, C, D) and each accounts for 45%, 36%, 15%, and 4% of total revenues respectively; and (ii) the overlap only exists in connection with the target’s business A (45% of revenues), then SAMR may force the parties to define markets in relation to the target’s remaining business units. However, Business D may be exempted if it also has a market share of less than 5%. ↑

- US Federal Trade Commission’s Merger Guidelines (18 December 2023) (https://www.ftc.gov/system/files/ftc_gov/pdf/2023_merger_guidelines_final_12.18.2023.pdf). ↑