China has recently implemented significant changes to the thresholds for merger control. On January 26, 2024, the ‘Provisions of the State Council on Thresholds for Prior Notification of Concentration of Undertakings’ (“Amended Thresholds”) came into effect. This update raised the revenue threshold for merger control filing for the first time and also reinstated the State Administration for Market Regulation (SAMR’s) jurisdiction over below-the-threshold transactions. A set of new thresholds that were originally proposed in the draft version for public consultation released in July 2022 (“Draft Amendments“), which aimed to address “killer acquisitions”, were ultimately removed from the Amended Thresholds. The Amended Thresholds underscore China’s ongoing efforts to enhance its competition policy and establish a more transparent and efficient regulatory framework.

Please click here to view the PDF version.

1. A substantial increase in the turnover thresholds

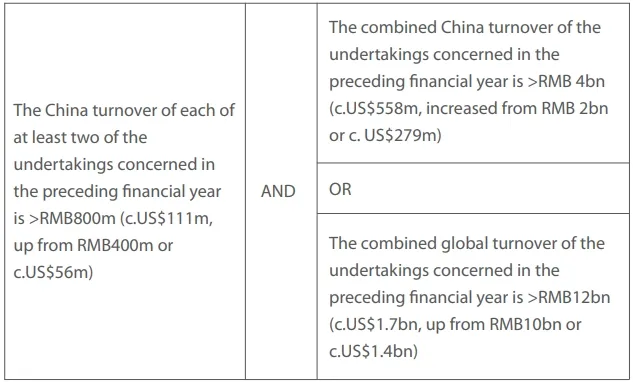

The current turnover thresholds, in place since 2008, have remained unchanged for over a decade. The Amended Thresholds represent a significant increase in these thresholds, particularly in China turnover. The updated thresholds are as follows:

These increased filing thresholds are expected to reduce the number of cases notified to the agency and the agency will have more capacity to review merger cases. Coupled with the delegation of merger control jurisdiction to five local counterparts, the review timeline is anticipated to be significantly improved in the sense that it should be reduced. The current average review timeline for simple and normal cases is respectively approximately 20 days and more than 190 days. A streamlined process is expected to enhance efficiencies and reduce uncertainties.

2. The “killer acquisitions” thresholds proposed in the Draft Amendments have been dropped

In the Draft Amendments, an additional filing threshold was introduced to address “killer acquisitions”[1] that impact the China market when a major corporation acquires a nascent firm with the intention of eliminating emerging competition. Under the “killer acquisition” filing threshold, a filing would only be triggered if:

- at least one of the transaction parties (e.g. the acquirer) has a turnover in China of >RMB 100bn

(c.US$15bn) in the preceding financial year; - the target has a market capitalization (or valuation) of >RMB 800m (c.US$120m); and

- the target generated more than one-third of its global turnover in China in the preceding financial year.

Under the “killer acquisition” thresholds, a buyer acquiring a target that does not meet the revenue threshold but has a relatively high market value (e.g. a unicorn company) would still be within jurisdictional reach. The Draft Amendments lacked guidance on how parties should calculate “market capitalization” or “valuation”. Presumably, the removal of the “killer acquisition” thresholds from the final versions was influenced by the controversies surrounding the use of “market capitalization” or “market value” as the threshold. Calculating the precise “market capitalization” or “market value” is inherently challenging due to market volatility, market sentiment, possible multiple stock classes or complex capital structure, as well as the complexity in valuing intangible assets. Consequently, relying on market capitalization (or valuation) to determine whether the threshold has been met would result in uncertainty.

3. Reinstatement of SAMR’s jurisdiction to call in potential anti-competitive below-the-thresholds

transactions

SAMR’s jurisdiction to investigate below-the-thresholds transactions that may be anti-competitive has been solidified by the amended AML, which is again included in the Amended Thresholds. The Amended Thresholds stipulate that transactions that fall below the threshold but are otherwise anti-competitive orpotentially competitive can be called in by SAMR. The details of the call-in procedure are provided in the Regulation on the Review of Concentration of Undertakings. If required by SAMR to notify the below-the-threshold transaction, the parties are not allowed to close the deal until clearance. In the event of a closed deal, the parties are required to notify within 120 days of SAMR’s notice and also take standstill measures.

Although there are no public decisions where SAMR or its predecessor had resorted to the call-in rights, there have been instances where call-in rights were exercised. For instance, SAMR proactively intervened in the case of Hunan Er-Kang Pharmaceutical Co., Ltd.’s acquisition of Henan Jiushi Pharmaceutical Co., Ltd., despite it not meeting the reporting standards, due to its potential exclusionary or restrictive effects on competition. After multiple rounds of communications, the parties ultimately abandoned the transaction.²

What do dealmakers need to know?

- The retrospective application of the amended thresholds remains uncertain. For instance, it’s unclear whether the Amended Thresholds apply to transactions signed but not closed before their implementation, or only to transactions signed after the Amended Thresholds come into effect. This ambiguity raises concerns about the risk of “gun-jumping” if a transaction, which falls below the Amended Thresholds but exceeds the current thresholds, is signed before the Amended Thresholds but closed after their implementation without notification. Similarly, if a transaction met the previous filing thresholds and was notified before the effective date of the Amended Thresholds, and the Amended Thresholds became effective before SAMR accepts or approves the notification, can the parties withdraw the notification if the new filing thresholds are not met? According to Article 30 of the Interim Provisions on Administrative Licensing Procedures for Market Supervision and Administration, after the administrative license application is accepted and before the administrative decision is made, if the application matter no longer requires an administrative license due to modification or abolition of laws, regulations, rules, the market supervision and administration department shall terminate the implementation of administrative licensing. According to this provision, such transactions that do not meet the new filing thresholds may possibly need to withdraw the notifications. Given the wide discretion of antitrust enforcement agencies in interpreting and applying rules, dealmakers should engage in discussions with antitrust enforcement agency on a case-by-case basis before the agency issues explicit interpretations, in order to avoid the risk of “gun-jumping”.

- With an anticipated reduction in the number of deals reviewed by SAMR, filings that meet the amended notification thresholds can expect a more in-depth review. Mergers meeting the heightened turnover thresholds should prepare for a comprehensive evaluation, including detailed discussions on market definitions, heightened scrutiny of market share data, and stricter formality requirements.

- While the “killer-acquisition” thresholds have been removed from the Amended Thresholds, it’s important to note that SAMR still retains the authority to establish jurisdiction over “killer-acquisitions” through its call-in rights for “below-the-thresholds” transactions.

- In sensitive sectors such as semiconductors and high-tech, SAMR retains wide discretion to investigate below-the-threshold transactions. Therefore, dealmakers should conduct a thorough substantive analysis to assess whether the transaction could raise competition concerns and be subject to SAMR’s filing request. They should also consider the corresponding implications on the transaction timetable. If dealmakers are uncertain about the potential anticompetitive effects of their transactions, they may consider making a voluntary filing or consulting with SAMR to prevent unexpected call-ins. Meticulous and proactive planning is crucial to avoid timetable delays due to SAMR’s exercise of call-in rights.

- Killer acquisitions refer to a situation in which an incumbent acquires an innovative target to stunt the target’s development and preempt future competition. These most commonly take place in the digital and pharmaceutical industries.↑

- See:https://www.gov.cn/xinwen/202012/25/5573435/files/195171fdee024615933c10d57f141171.pdf.↑