On August 23, 2024, the Asset Management Association of China (AMAC) issued three notices: (1) the “Green Investment Self-Assessment” and related survey, which have been conducted annually for five consecutive years since AMAC issued the “Green Investment Guidelines (Trial)” in November 2018; (2) the “Notice on the Release of the Private Fund Manager Registration Information Change Business Process ‘One-Stop Diagram’ and Supporting Instructions” (“Instructions for Changing Manager Information“); and (3) the “Private Fund Registration and Filing Dynamics (2024 Issue 1)” (“2024 Dynamics“). Industry participants have been particularly interested in the latter two notices, which directly involve the practical guidelines on change in private fund manager registration information and provide case studies related to private fund registration and filing.

Please click here to view the PDF version.

I. Instructions for Changing Manager Information

The Instructions for Changing Manager Information released by AMAC follow the “Private Fund Manager Registration Business Process Diagram” issued on April 15, 2024. It maintains a consistent format of “process diagram + supporting instructions,” providing a comprehensive overview and detailed explanation of the information change process once the manager has completed the registration process. With this new diagram, AMAC has created a comprehensive guideline for private fund managers to register and change their information and to voluntarily deregister their managerial status.

Three key highlights are worth noting from the Instructions for Changing Manager Information:

Reflecting the Concrete Implementation of Current Regulatory Rules on the Basis of System Modules and Practices

The Instructions for Changing Manager Information categorize and organize information change instructions based on whether the change is to basic information or to major information or in actual control:

- Basic information changes: Basic information changes include (i) changes to a private fund manager’s office address, credit information, and related-party information, which should be automatically updated by the system under “Manager Information Updates,” and (ii) some more significant changes requiring AMAC’s review, which are classified as and should be reported in the system under “Major Matter Changes”. These major matter changes include changes to a private fund manager’s name, business scope, capital, registered address, shareholders, partners, legal representative, and senior management.

- Major information changes: Major information changes refer to significant alterations, such as changes to controlling shareholders, actual controllers, or general partners.

- Change of control: Change of control refers to changes in actual control of a private fund manager.

The instructions also emphasize regulatory requirements and business procedures, including reporting deadlines, expected processing times, legal opinion requirements, special regulatory requirements for a higher scale of assets under management (AUM) in case of changes in actual control, and compliance consequences for a private fund manager if its change application is terminated by AMAC. Additionally, the Instructions for Changing Manager Information clearly reference and highlight relevant clauses under current regulatory rules, such as the “Measures for the Registration and Filing of Private Investment Funds” (“Registration and Filing Measures“) and the “List of Application Materials for Private Fund Manager Registration” as well as channels for downloading these materials and for seeking consultations and lodging complaints about any private fund manager’s non-compliance acts.

Providing a Full-View Guide from Both Internal and External Perspectives

On the basis of categorizing and organizing AMAC internal processes (such as the AMBERS system, the practitioner system, etc.) by color and module, the Instructions for Changing Manager Information also provide guidelines for changes to information related to change registration with the local counterpart of the Administration for Market Regulation (AMR), requiring managers to apply for changes with the local AMR where the manager is registered. By emphasizing the need to be aware of relevant local registration policies, the diagram provides a practical and feasible guide for the smooth execution of the manager registration information change process.

Emphasizing Ongoing Compliance in Manager Operations and Strengthening AMAC’s Daily Supervision

The Instructions for Changing Manager Information specifically mention AMAC’s regulatory responsibilities in daily supervision and regular inspections once a fund manager completes its registration information change process with AMAC. It urges private fund managers to promptly fulfill their obligations regarding change procedures, information disclosures, reporting and updates, and significant matter reporting in accordance with regulations.

II. 2024 Dynamics

The 2024 Dynamics released by AMAC mark the second update to AMAC’s Private Fund Registration and Filing Dynamics since the publication of the “Private Fund Registration and Filing Dynamics (2023 Issue 1, Total Issue 1)” in August 2023. This new update signifies that the dynamic update model, which is aimed at responding to industry concerns in a timely and effective manner and conveying self-regulatory requirements, has entered a phase of regular management and operation.

The new issue of the 2024 Dynamics primarily focuses on summarizing new developments and issues in private fund manager registration since the implementation of the Registration and Filing Measures, with a particular emphasis on the following three typical problems with case studies to illustrate each:

False Registration Materials

In Case 1, a private equity fund manager applicant used image synthesis technology to forge a resume and investment performance materials for a senior management position. An unqualified individual, Mr. A, who had only worked as an administrative assistant for another private fund manager for three months and had never been involved in any investment business, was falsely presented to AMAC as a qualified senior executive responsible for investment management. The law firm and the handling lawyer also issued a positive legal opinion letter regarding this individual’s qualifications. After AMAC’s investigation, the registration process for this private fund manager was terminated. Measures were taken against the controlling shareholder, actual controller, legal representative, senior management, law firm, and the handling lawyer. These measures included prohibiting the controlling shareholder, the actual controller, the legal representative, the responsible senior manager, the directly responsible and unqualified individual (Mr. A) from serving as a controlling shareholder, an actual controller, a general partner, a major investor, or a senior executive of a private fund manager for three years. Additionally, the main responsible personnel were barred from obtaining registration for fund qualification for three years.

Case 1 not only highlights AMAC’s “zero tolerance” policy toward fund managers and practitioners for false reporting and document forgery in the registration and filing process, but also serves as a warning to law firms and handling lawyers involved in private fund manager registration legal services. Relevant law firms and handling lawyers must fulfill their duty to conduct diligent investigation. If the documents they issue contain false statements, misleading representations, or material omissions, AMAC may take regulatory measures such as issuing reminders and written warnings or even refusing to accept any documents issued by the lawyer or law firm. AMAC may also publicly disclose these measures on its official website.

Unsound Financial Status and Operational Conditions of Controlling Shareholders and Actual Controllers

Article 9 of the Registration and Filing Measures requires that the controlling shareholders and actual controllers of private fund managers operate in a stable and regulated manner, maintain a sound financial condition, maintain appropriate asset-to-liability and leverage ratios, and have the ability to continuously supplement capital in line with the operational needs of the private fund manager. However, the specific definition of “sound financial condition” had not been clearly explained before now. That gap is now filled by Cases 2 and 3 of the 2024 Dynamics.

In Case 2, AMAC clarifies the detailed criteria it uses to assess and determine whether controlling shareholders and actual controllers possess “sound financial conditions”. These criteria include: Is the debt level relatively high? Are the financing methods conventional? Is the asset-to-liability ratio high? What is the asset’s profitability? Is the daily operational income sufficient to cover debt costs?

In Case 3, AMAC further elaborated on additional criteria for reviewing industrial groups engaged in cross-sector business operations. These criteria include: How many related parties are there? What is the structure of the equity network? Are there any significant and abnormal fund transfers between shareholders and related parties, or other risks of conflicts of interest and tunneling? Is there a considerable risk of self-financing?

These two cases provide clearer guidance on financial conditions and conflicts of interest in business operations, particularly for entities in traditionally high-debt sectors or large corporate groups that wish to transition into or engage in private fund management by serving as controlling shareholders or actual controllers of private fund managers.

Unqualified Controlling Shareholders, Actual Controllers, and Senior Management

In Cases 4 to 6 of the 2024 Dynamics, AMAC highlights its regulatory approach of focusing on the “key minority” and their professional competence from various angles.

Specifically, Case 4 clarifies that special purpose vehicles (SPVs) that have not actually engaged in business activities and are only used as shareholding platforms for the manager do not meet the experience requirements for controlling shareholders. Registrations listing these unqualified SPVs as controlling shareholders will be returned by AMAC for correction.

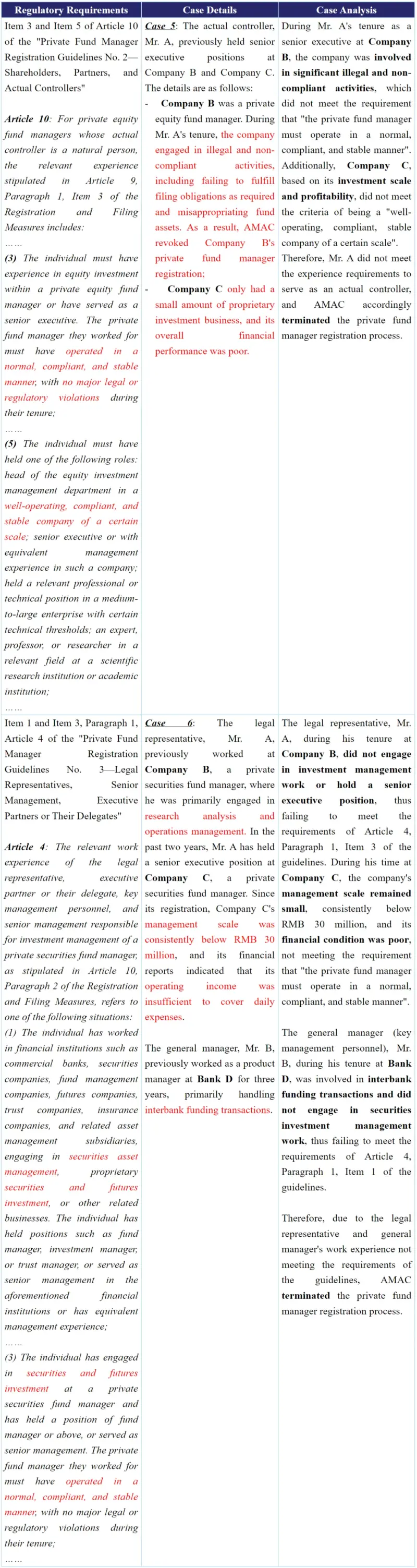

Cases 5 and 6 provide detailed scenario-based analyses of the professional experience required for individual actual controllers and senior management of private securities fund managers, as outlined in the “Private Fund Manager Registration Guidelines”. The key points from these analyses are summarized as follows:

Due to the complexity and variety of market participants, personnel and transactions, determining the qualifications and professional experience required for controlling shareholders and actual controllers has always been both a key focus and a challenging issue. The previous cases provide clearer guidance for industry participants.

Conclusion

The two new regulatory updates issued by AMAC — the Instructions for Changing Manager Information and the 2024 Dynamics — represent a small step in AMAC’s ongoing efforts to improve and refine its day-to-day regulatory framework as part of its commitment to regulatory transparency and to fulfilling its role in serving the industry. These updates are also highly beneficial in helping the industry better understand and interpret regulatory requirements. We look forward to seeing continued collaboration among industry participants such as industry practitioners and intermediary institutions to promote the steady and orderly development of the private fund market under the positive guidance of regulatory authorities.